With short-term interest rates at their highest level since 2008, it is easy to sympathise with the view that cash looks tempting.

If investors can get 4-5% with no risk of capital loss, why invest in stocks, bonds or mixed-asset funds?

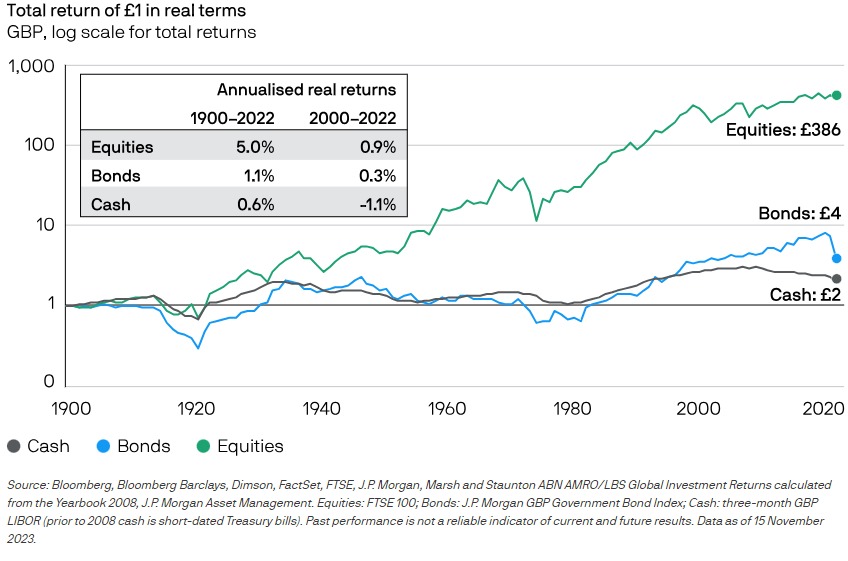

But today’s cash rates are a mirage. They are likely to disappear as we get closer to a recession. Over a longer time horizon cash rates look far less attractive: £1 invested in 1900 in money markets would have amounted to just £2 by 2022 in real terms, i.e. adjusted for inflation.

Bonds would have returned £4 over the same period. By far the best performer on a real basis was equities, returning £386.

While cash might seem like a safe bet with current high-interest rates, it’s important to remember that these rates could drop as we near a recession.

Looking back over time, cash hasn’t been a great long-term investment compared to bonds and especially stocks, which have delivered much higher returns.

So, it’s wise for investors to consider a mix of assets, including stocks, for better growth potential in the long run.