YOUNG ADULTS

As young adults transition into independence, financial planning focuses on building a strong foundation for the future. This stage involves setting financial goals, such as saving for emergencies, paying off debts, and establishing long-term savings and investment strategies.

Starting a pension

The very best time to start a pension is when you are young.

Emergency Fund

It is essential to have some savings set aside for unexpected expenses, typically three to six months’ worth of living expenses.

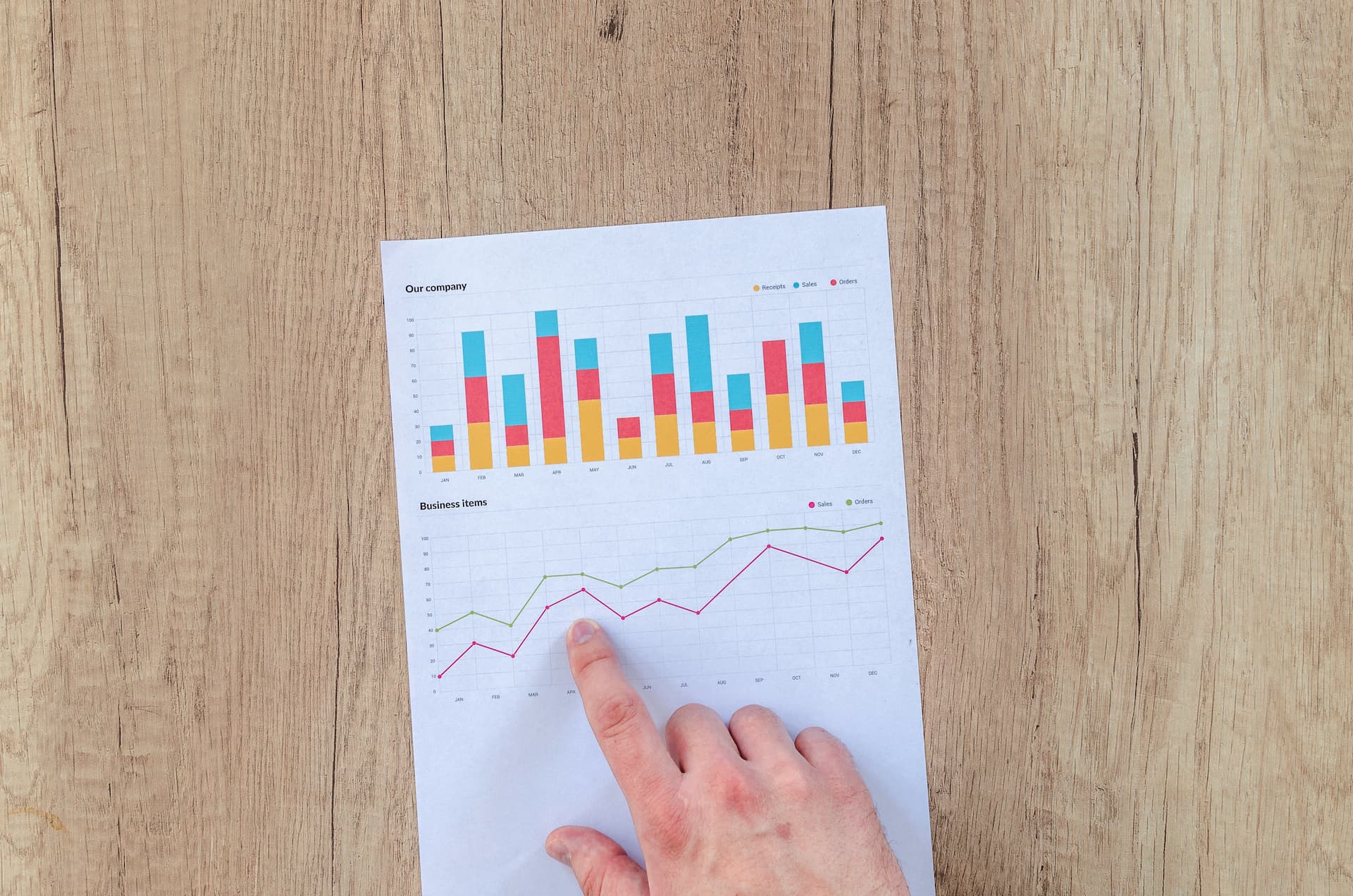

Investment Strategies

For long-term goals like retirement, consider investing in a diversified portfolio of stocks and bonds. It’s generally advisable to start investing as early as possible to benefit from compounding returns.

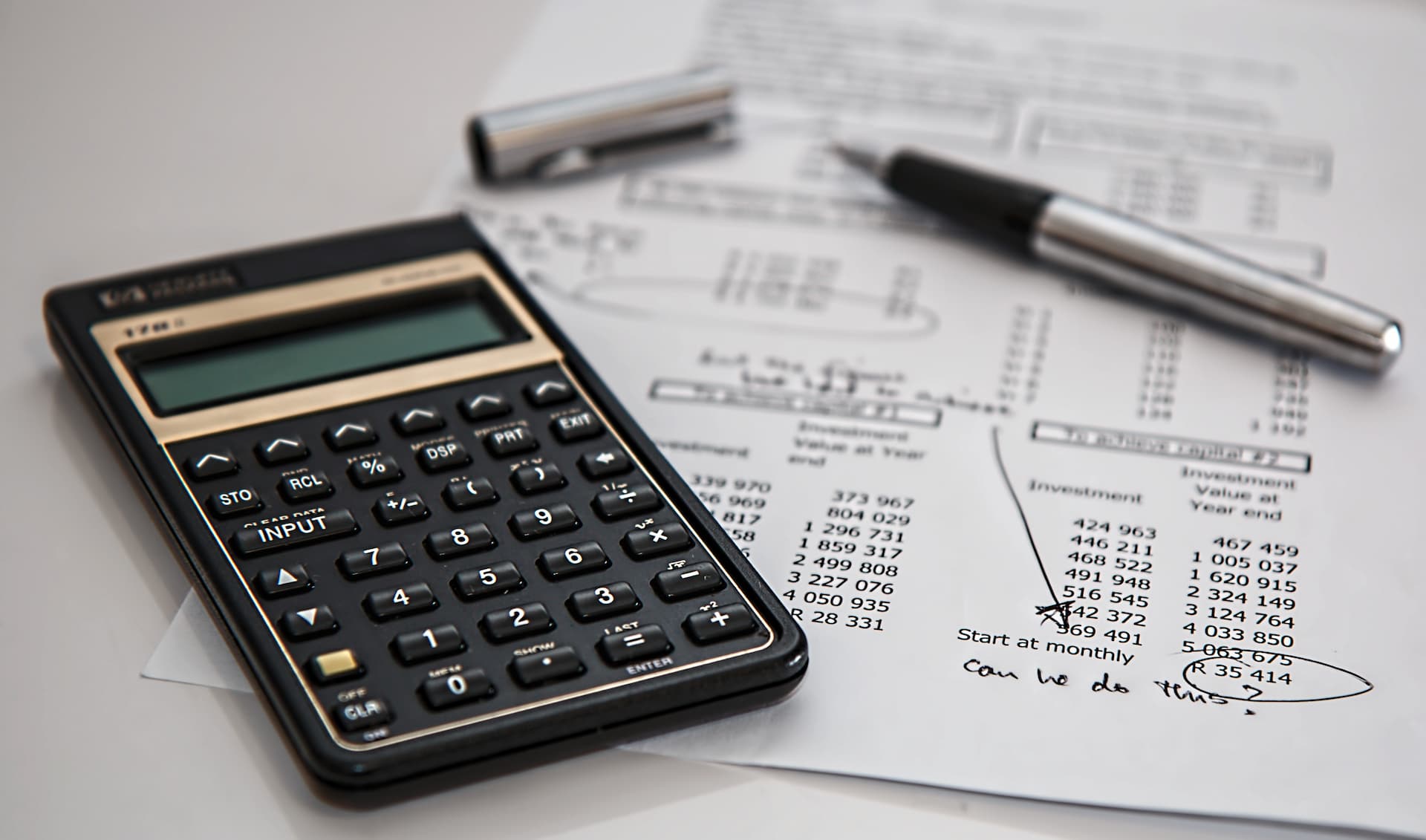

Budgeting

Creating and sticking to a budget is fundamental. This helps you understand your financial situation and allocate money towards savings and investments.

Long Term Saving

ISA’s provide tax-free savings opportunities. There are different types of ISAs, including Cash ISAs and Stocks and Shares ISAs, which can be suitable for various goals.

Paying Off Debts

Young adults can have various types of debts dependign on their financial situation and life circumstances. Some common types of debts that the average young adult might have are: Student Loans, Credit Card Debt, Personal Loans, Car Loans, Overdrafts, Payday Loans

Get In Touch With Us

If you like what you have seen on our website, the next step is to get in touch, we offer a free initial discussion with no obligation. You can do this face to face, by phone, or on Skype.

It would really help if you could tell us your reason for getting in touch.

Please rest assured that we take your privacy very seriously: We will never share or sell your personal details to anyone without your permission.

Notice: You can not enter where the red marker is, please use any other entrance such as the top of station road.