What is an Independent Financial Adviser? Or IFA?

An Independent Financial Adviser (IFA) can increase your wealth by applying planning and analytical skills to:

- Help you to identify your goals, then build a plan to achieve those goals

- Offer savings and investment products from the ‘whole of the market’ with no ties or bias

- Offer a wide range of products and services available in the UK.

- Use our experience and leading research software to compare the multitude of products available

- Use sophisticated tools to forecast your future wealth to help you stay on track in achieving your goals.

We are answerable only to you, our client, and to our regulator – the Financial Conduct Authority.

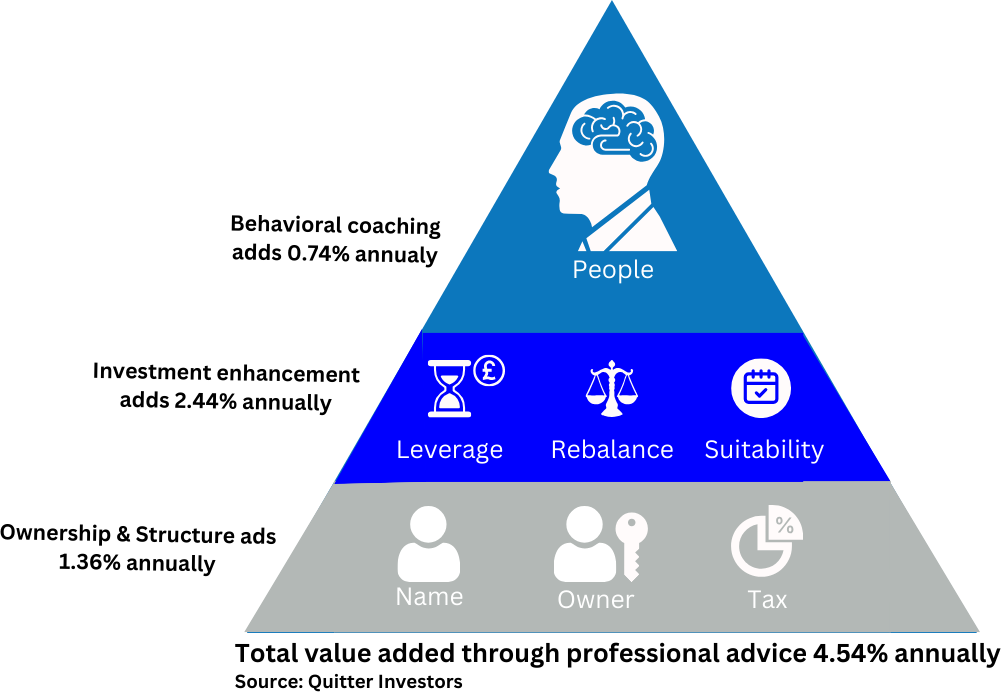

The Value of Independent Financial Advice

Did you know that independent financial advice can increase your wealth? Research proves that clients who have received financial advice are better off than those that haven’t:

- Receiving financial advice resulted in approximately £27,664 in additional pension wealth

- the overall value of receiving financial advice is approximately £41,099 additional financial and pension assets.

- Those who took advice have accumulated 20% more assets than those who have not taken advice.

Source: The value of financial advice A Research Report from ILC-UK. Assessed over the period 2001-2007.

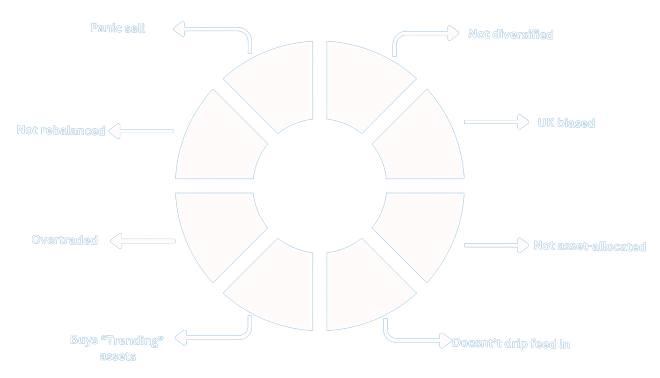

The Risks of Self-Managing Investments

Low-cost, DIY investment platforms can cut charges—but self-managing often leads to costly mistakes. Common pitfalls include:

- Poor diversification – putting everything into one type of fund.

- Ignoring global risks – overlooking the ups and downs of overseas markets.

- Chasing “star” managers – and losing out when they fall from favour (none of our advised clients were caught in that collapse).

- Following fads – overloading on hot sectors like tech, forgetting lessons from past crashes like the Dot-com bubble.

- Misjudging strategy – active, passive, or trend-following; knowing when each works best is crucial.

Without clear strategy and discipline, these errors can undermine your long-term returns.

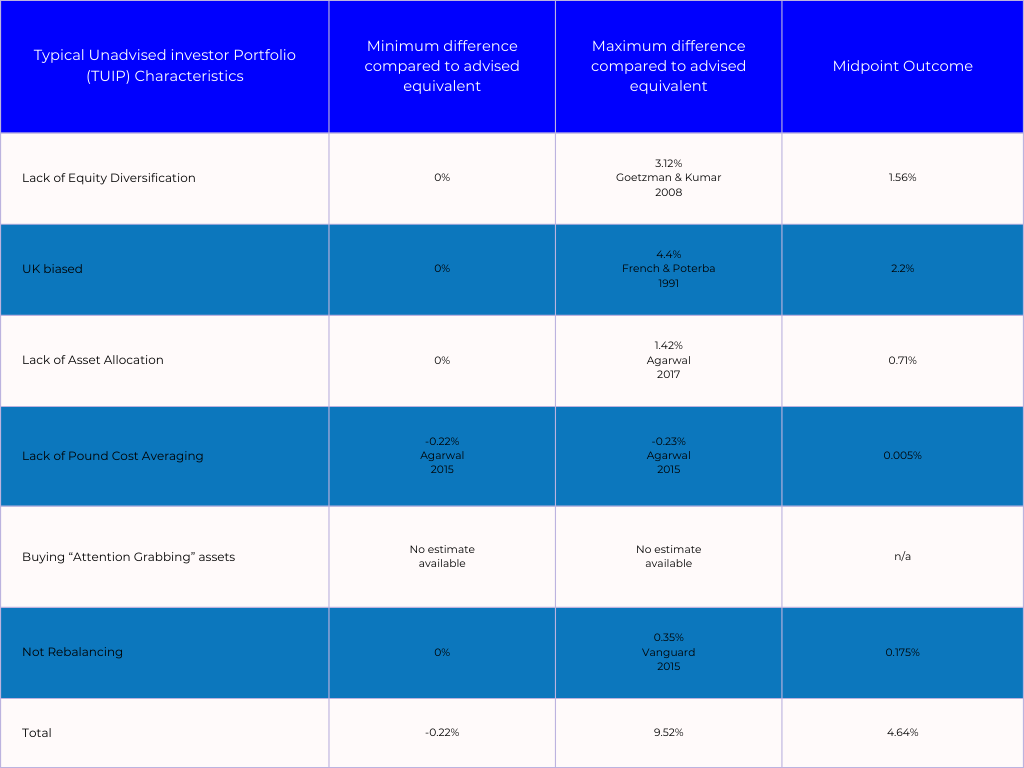

Research studies have been able to quantify the mistakes made by unadvised investors, resulting in a combination of factors that could see you missing out by on average 4.64% per year:

Are Independent Financial Advisers expensive?

Not when you consider the value. Our typical hourly rates are in line with solicitors and accountants—reflecting the qualifications, expertise, and responsibility we carry.

We provide:

- Personalised advice – tailored to your circumstances, goals, and family needs.

- High professional standards – fully FCA-regulated, with our advice covered by the Financial Services Compensation Scheme.

- Expertise you can trust – highly qualified advisers with specialist knowledge and ongoing professional development.

- Proven client satisfaction – backed by our 5-star Google Reviews.

- Transparency – all fees are agreed before we advise.

Financial planning isn’t just about picking products—it’s about balancing complex legal, tax, and investment issues to build a secure financial future.

We provide:

Questions? Call us on 01202 622223 or use our online enquiry form.